Know and Reach Your Customers With Market Segmentation Data Analysis

What if you could know exactly which customers are worth spending your marketing dollars on and which ones aren’t? What if you could analyze the traits of your best customers and strategize to encourage those habits in other customers? What if your sales team could know which accounts you can’t afford to lose or which type of customer was the most profitable to target?

Relational, personalized marketing is now the baseline expectation from customers and clients, but personalization is impossible unless you can get a clear picture of the different customers you serve and where they are in the customer journey. Very few businesses have one type of customer, so treating your customers according to their individual needs is essential.

But if you have thousands or even hundreds of thousands of customers how can you possibly tailor each customer relationship? Customer service or sales representatives can only do so much to engage each customer on an individual basis, and demographic data analysis isn’t detailed enough to tailor their experience.

Enter market segmentation data analysis. Rather than just analyzing and categorizing your customers based on how much they spend, their age, or their location, you can use market segmentation data analysis to create detailed customer groups that have similar personas and purchasing behaviors, treating each type of relationship with the exact attention and action needed to promote growth. With market segmentation data analysis, you use customer data to continually strengthen relationships with your best customers and avoid losing customers as a result of inaccurate or ineffective communication.

Market segmentation data analysis goes beyond improving your email marketing. It can help you:

- Identify high value customers

- Build brand loyalty and drive loyal behavior

- Understand and design the customer journey

- Meet customers at their interest level

- Provide relevant offers

- Improve customer retention

- And deliver more value to your customers (because you know what they want).

What is market segmentation data analysis?

Market segmentation data analysis is a method of breaking your customers or potential market down into actionable categories- into groups that you can treat differently from one another in an effort to reach them more effectively. The division is often based on the customer’s needs, buying characteristics, responses to messaging, or chosen marketing channel. Rather than mass-marketing, market segmentation data analysis allows you to tailor your interaction with your customers based on their unique buying habits, interests, demographics, and history with your company.

Segmenting customers is not a new idea, so there are several approaches that companies traditionally take for market segmentation data analysis. Methods commonly include demographic segmentation, segmenting by sales percentage, or even the more detailed RFM segmentation that looks deeper into customers’ buying habits. We propose that with new machine learning methods for market segmentation data analysis you don’t just have to choose one of these segmentation methods to categorize your customers. Instead of limiting yourself to one type of segmentation that only takes a limited amount of customer characteristics into account, you can combine all the characteristics that make a valuable customer and use machine learning to group people based on how they compare in those valuable categories.

All market segmentation data analysis methods involve:

- Aggregating transactional and demographic data about your customers

- Identifying characteristics that contribute to a customer being valuable to your company

- Organizing those customers based on similarities to those identified characteristics. This may involve either using machine learning to analyze larger amounts of characteristics or traditional data science methods for less complex grouping.

Once customers are appropriately grouped with the chosen market segmentation data analysis method, organizations can then decide how to reach them individually whether for marketing, sales, or customer service purposes.

Demographic Segmentation

Demographic segmentation data analysis focuses on separating customers into groups that share similar demographics such as age, gender, geographic location, etc. This is a very common type of segmentation, but isn’t enough to truly reach your customers in an individualized way, as customers of a similar age or geographic location could easily have different interests or purchasing habits. Even if you target someone within the same age group, they might not be in the same part of your customer journey for your company, or they might have vastly different interests.

This segmentation strategy may still be useful, though, if the promotion or message you need to convey directly applies to customers of a certain demographic. For example- it could be used effectively to reach local customers with an in-store promotion, as only people in the area would be interested in going to the store to redeem it.

Segmentation Based on Sales Percentage

One of the simplest ways to segment customers is to look at the top percentage group of spenders and send them promotions most often, assuming that they are the most interested in your brand. What this might not account for, though, is how often they make purchases, how long ago their last purchase was, or whether the customers within the top group of spenders are alike at all. You at least know that these customers are more interested in your products or services than those who haven’t spent anything within a certain time period, but this market segmentation data analysis method still only analyzes one main characteristic of the customer- their spending.

Using a sales percentage to determine who is a high value customer also arbitrarily bars other important customers from recognition. What if someone isn’t in the top 10% of recent spending, but in fact has spent money regularly from your company for the past 5 years? What group would they fall into for you to target? Even though a customer isn’t in your top 10%, they might have other valuable characteristics as a customer that you could speak to. If you hope to transform as many customers as possible into your best customers, your method for market segmentation data analysis should help you understand all your customers better, not only your top customers.

According to Forrester, more traditional methods like demographic segmentation and sales percentage segmentation are commonly the cause of companies feeling like their market segmentation data analysis efforts show lackluster results. In fact, 33% are disappointed with the results of their segmentation efforts. Why is this so? Think- even though you are the same age and perhaps live in the same place as someone at your workplace, you may be vastly different people. There has to be a way to perform market segmentation data analysis in a more holistic way to reach them with more impact.

RFM Segmentation (Value Based Segmentation)

RFM segmentation is more effective than the previous two market segmentation data analysis methods, as it takes into account not only the amount purchased but how often and how recently. It uses data analysis to rate customers based on three variables: Recency (R), Frequency (F), and Monetary (M).

- Recency tells you how recently customers have made a purchase with your company, assuming that customers that made a purchase more recently will be more receptive to promotions or communication. Recency is the clearest way customers can communicate their interest level.

- Frequency tells you how often a customer makes a purchase, helping you identify all-star consistent spenders and even first-time purchasers.

- And finally, the monetary characteristic tells you how much a customer has spent with your company within a certain period, helping you identify big spenders and possibly deprioritize customers who have made only minimal purchases.

These three characteristics give you a holistic analysis of your customer’s purchasing habits in order to assess which customers are of highest economic value to your business. The frequency and monetary characteristics convey a customer’s lifetime value, and recency shows how engaged they are with your brand.

Customers’ recency and monetary data can tell you whether they’re losing or gaining interest and can provide insight into your customer retention rate. For example, if 90% of your customers are in a customer group that makes one big purchase but then never purchases again, this shows that you’re successfully acquiring new customers but somewhere along the way aren’t able to keep them or gain their loyalty. You can use this data from market segmentation data analysis to adjust your marketing strategy or possibly even your overall business strategy.

By rating a customer in each of the three areas, RFM segmentation data analysis gives each customer an overall “score” that shows you their value as a customer. You can then separate customers out into more specific groups that tell you more about their relationship with your brand based on their activity, engagement, and spending.

RFM segmentation data analysis does a more holistic job of treating customers uniquely, but it still allows for quite a bit of ambiguity. For example, if customers are rated on a scale of 1-3 in each of these areas, customers that score a 6 could score that in multiple ways. One customer might have a monetary rating of 3 but be low in their recency (1) and frequency (2), meaning that they are less engaged with your brand than a customer who scored a 3 in recency and 2 in frequency, but didn’t spend much (1). Customers may come to a value ranking with different purchasing habits and a different affinity for your brand, so it is essential to be able to separate these customers into different groups so that you can grow them into high value customers.

So how do you resolve this issue of only looking at your customer based on limited variables and an analysis that doesn’t differentiate customers in a detailed enough manner? You add more variables to your analysis of your customer data, and in order to analyze customers based on more variables you need machine learning.

Using machine learning for market segmentation data analysis

With machine learning you can analyze your customer data based on an unlimited number of characteristics. Finally- a market segmentation data analysis method that allows people to be as complex as they truly are and doesn’t limit you to seeing people based on a few characteristics like their purchasing value. Your customers will be able to tell the difference.

Using machine learning models for market segmentation data analysis, you can combine the information that would traditionally be used in demographic or RFM segmentation to create a well-rounded view of your customer and understand more facets of your relationship with them. You can include niche characteristics in your analysis like what types of products the customer likes, previous campaign response rates, their awareness or intent (whether they came directly to your website or through another channel), engagement level, and more. All of these characteristics contribute to a customer’s overall value and help you understand your relationship with the customer.

Instead of taking a fixed number of characteristics like you would with RFM segmentation or other traditional data analysis methods, you as a company can decide what characteristics define a high value customer and then segment your customers based on those characteristics. For example, a high value customer might look completely different for an investment company than for a retail business. At an investment firm, they might value accounts that contact them the least and have invested the most and perform data analysis to find those customers, whereas a retail company is looking for customers with frequent, big purchases. Value is in the eye of the beholder, and by using machine learning for market segmentation data analysis, you get to determine what factors translate to value for your company.

So now that you know about this method, what can you do with your new marketing superpower?

What market segmentation data analysis does for your business

When you meet customers where they’re at and give them what they want, they keep coming back, and market segmentation data analysis tells you that important information about what they value and want from your company. Market segmentation data analysis can help you:

Identify High Value Customers and Move More Customers Into That High Value Bracket

The top 5% of customers on average spend 10x more than the other 95% and tend to represent a third of your total revenue. Identifying those customers that are the most important to your business in order to keep them happy and grow the relationship is vital. They’ll be the most likely to refer you to friends, share about your products, and keep coming back for more. Your marketing efforts should show appreciation for these most important customers identified by market segmentation data analysis and deepen the relationship.

Understand How Your Customers Are Unique and Connect With Them Better

You choose to say different things to different friends. Why? Because you know them. You know what they like. You have a history. It’s personal, and understanding your history and commonality enriches the relationship. A key benefit of market segmentation data analysis is that you can more accurately identify a wide variety of customer types, develop customer personas, map the customer journey, and then market toward each of those personas.

Here are ideas of niche customer groups that you may find with market segmentation data analysis:

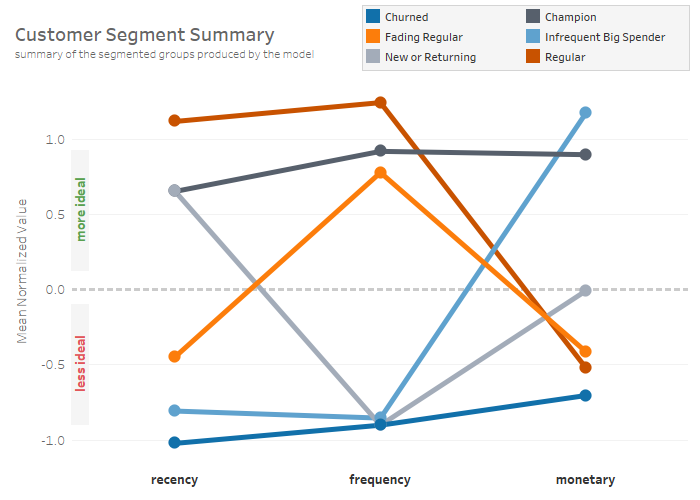

- Champions (Your Best Customers): These customers give you the biggest bang for your buck. They’re loyal and supportive. They spend frequently and spend the most. They also might share other important characteristics like showing high engagement on your website and social media, buying a wide variety of products, or buying newly released products quickly. For these customers you can focus on keeping them happy and even releasing products and campaigns specifically geared toward their interests.

- New or Returning Customers: These customers either just discovered you or reconnected with your brand. It’s essential to maintain these relationships and treat them very differently than any other customer type. New or returning customers have the potential to enter any other customer group based on their initial impression and interaction. You can watch how their actions change over time to identify what other customer groups they might start falling into and lead them in a profitable direction.

- Regular Customers (Oftentimes Active, Low Spenders): These customers are very engaged with your brand but don’t spend a lot. Instead of treating them the same as your best customers (the ones that make you the most money), you can target them with promotions that encourage them to increase their spend (like giving $10 off of $100 rather than a 10% off of any amount). You can also use their consistent loyalty to help spread brand awareness by offering rewards for referrals. Although this group isn’t in your best customer group, they shouldn’t be overlooked and easily could become or recruit a best customer in the future.

- Fading Regular: These customers have a high frequency rating but have not made a purchase recently. With customer segmentation data analysis, you can set up alerts to know when regular customers decrease in recency and start falling into the fading regular category. You can then try to pique their interest with new promotions or intentional communication.

- Infrequent Big Spender: This customer has a high monetary rating, but has not purchased often or recently. Their recency may spike one or two times a year for example, and when they spend they spend a lot. Take time to analyze the characteristics of this customer group. Is this common in your industry for customers to make infrequent large purchases? What can you do to maintain that relationship or potentially increase the frequency of their purchases? Would they spend more often if you had certain products or services they needed?

- Churned Customers: There are several types of customers that may be in the churned customer group, and each should be treated differently based on their characteristics. (You could even use market segmentation data analysis on this group alone to further separate and understand your churning customers.) A churned customer might look like someone who interacted with your company once and then left or someone who used to be a big, frequent spender but then suddenly stopped purchasing. Each of these customers most definitely should be treated differently if you hope to get them back, and it’s even better if you can catch them before they churn. Use market segmentation data analysis to identify the most common reasons that your customers leave, analyze tell-tale signs that they’re about to leave, and then take note when other customers start showing those tell-tale “churned customer” characteristics.

Other customer groups that might show up in your data but that aren’t illustrated in the above visualization include:

- Customers with Potential: This group is nearly as important as your best customers- because this group is most likely to be transformed into your next “best customer”. You can identify what customers don’t quite make the cut as your “best customers” but that still show some loyalty and engagement that is valuable to you. You can then strategize to encourage greater loyalty, larger purchases, or more frequent engagement.

- Low Value Customers: Lastly, consider that some customer types may not be a good fit for your business model and might not be the best use of your marketing spend. Market segmentation data analysis can show you what type of customer isn’t profitable to maintain your relationship with. You can then focus on customers that will more easily generate a profit and grow those long-term relationships.

The more traditional market segmentation data analysis methods are pre-designed to find certain customers (like the top 10% or even those who most recently purchased). Data analysis through machine learning takes all of your customers into account and groups them based on every possible similarity, regardless of whether you planned on isolating that group or not.

Why is this important? By using machine learning for your analysis, you’re not using leading questions to find things out about your customer base; you’re merely letting the data tell you something about your customers. There is more room for discovery. For example, if you build a model that segments your customers into 10 groups, the machine learning model may segment them in a way you didn’t expect or notice based on characteristic the customers share. This could be extremely valuable, as it pulls out similarities you might not have known to capitalize on. Using machine learning for market segmentation data analysis is a gold mine for learning more about your customers because you don’t limit yourself to your own field of vision or knowledge of your customers.

Map Your Customer Journey and Strategize to Increase Loyalty

With these specific customer groups from your market segmentation data analysis, you can start mapping a customer journey and design marketing strategies toward each stage to move your customer into greater loyalty. Also you can design this customer journey based on how you observe customers already interacting with your brand and company, rather than creating “ideal customer groups” that your customers just don’t naturally fall into.

What does this look like in action? Consider that your customer service representative could immediately understand that a certain type of customer is extremely valuable and know to take every effort to retain that customer, understanding their longstanding relationship just by looking at their customer group label. Or they could notice that this customer is calling but hasn’t made a purchase in years. For this they could apply predetermined methods for reintegrating customers or offer promotions that are just for returning customers. A sales representative could quickly recognize that they are speaking with a first time customer that has made a large purchase and tailor the conversation toward other helpful services.

Having a clearly mapped customer journey with strategies for encouraging customers at every stage helps employees in sales, marketing, and customer service interact more effectively and build upon the relationship rather than degrade it.

Learn More About Your Business and Refine Your Business Strategy

Market segmentation data analysis with machine learning can tell you more about your business than traditional market segmentation data analysis methods or than trying to deduce customer information from data in Excel. You may discover through this analysis that your best customers are in a group that only has 1-4 people, but that those 4 accounts make up 10% of your profit. That could drastically narrow the focus of your sales team and clarify their efforts.

Additionally what if you found out that there are a large percentage of customers in your “churned” customer group that used to purchase very frequently. You could study those particular customers to understand at what point they started spending less and look for commonalities in their experiences. Maybe they got to a certain point of spending and wanted additional services that your company did not provide. Instead of losing valuable customers in the future, you may decide to add those services to your offerings in order to retain those customers. The data behind every customer group can provide valuable insight into the effectiveness of your business model and customer relationships.

Gain and Maintain Your Competitive Edge

Finally, by listening to your customers and understanding them more deeply through market segmentation data analysis, you gain and maintain your competitive edge. In 2019, 47% of B2C marketing leaders said they planned to increase their spend on content and personalization technologies. Companies that connect best with their customers succeed, and poorly timed, generic messaging and marketing strategies increase churn.

If you’re listening intently to the needs of your most loyal customers and even using their feedback and wishes to develop your products and services, you proactively answer their needs and avoid losing customers to a competitor. Customers with potential will stop falling through the cracks and instead grow into their own unique place in your mapped customer journey.

What do you need to get started?

Most businesses already have the data available that they need to start market segmentation data analysis, and if they don’t it’s certainly not difficult to gather that data. You can start with your customer transaction data and any demographic data available, and over time you can identify and analyze what other data would help you assess customer value and create a fuller picture of your ideal customer.

We suggest starting to put market segmentation data analysis to use by identifying and reaching your highest value customers first. Your highest value customers already love your products and have a positive disposition toward your business. They are your lowest-risk group to start targeting. You can then move on to create and test strategies to reach and grow other customer groups. This highest value group will also show you what attributes make your ideal customer so that you can start trying to attract customers that closely fit those characteristics.

If you can identify which customers are the most valuable to your business and multiply that group, you will scale your business more effectively than wasting marketing dollars on customers with less potential. We’d love to help you get started with market segmentation data analysis and understand how you can use it to identify high value customers and clients, reach your customers most effectively, and maintain your competitive edge.

Is your database a business asset?

Check out our tips for assessing if your data is being used to its full potential: